The Estate Planning Process: What to Expect in Ogden

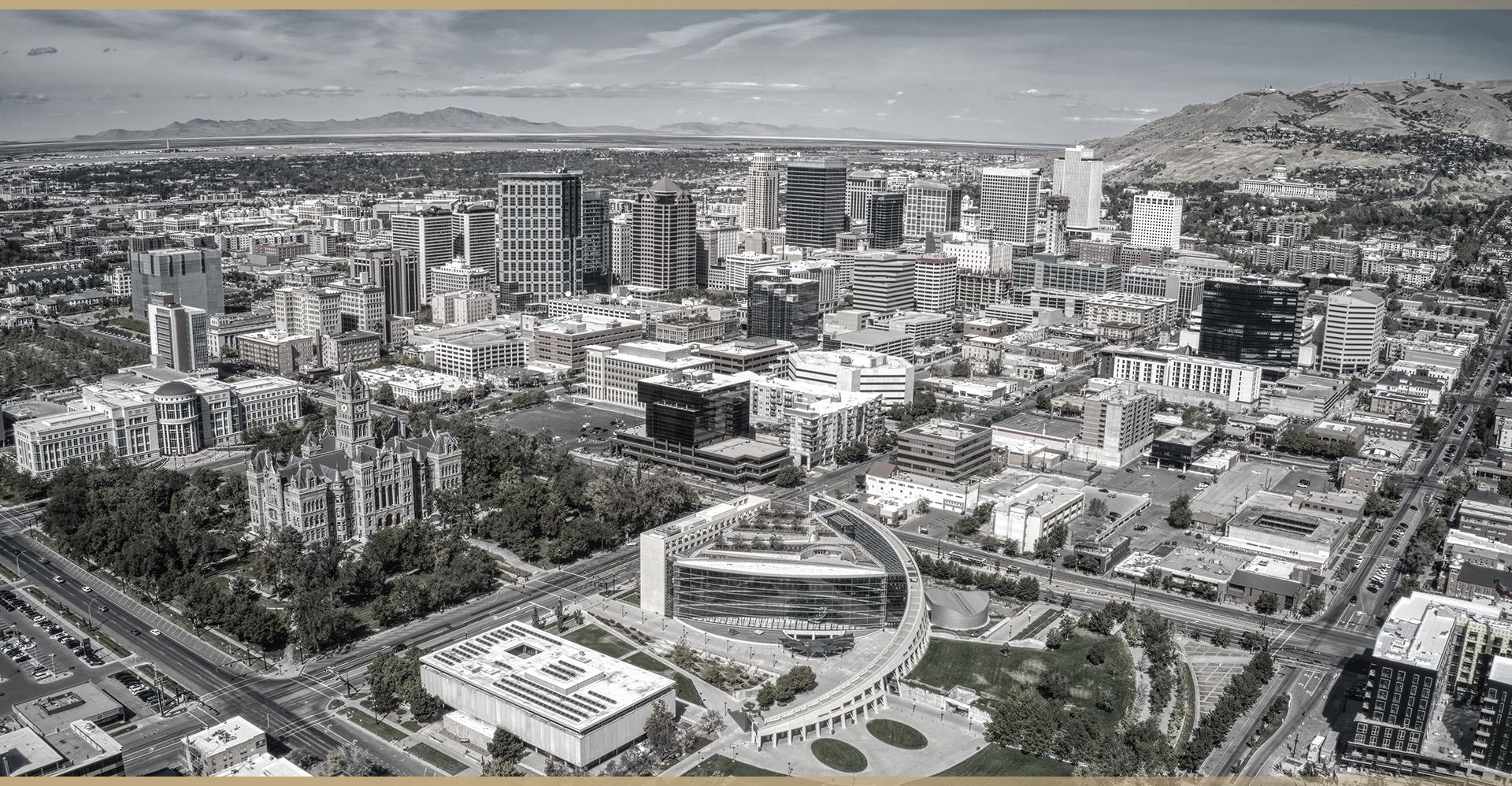

Understanding what to expect during the estate planning process relieves uncertainty and gives you confidence as you move forward. Your journey starts with a detailed consultation, where you discuss your assets, family structure, and long-term goals. In Ogden, the planning process reflects local needs, including Utah's rules about property distribution and probate court protocols in Weber County, plus tax implications that apply to certain assets.

During your consultation, you and your estate planning attorney will identify objectives, review all assets and existing documents, and pinpoint areas where legal planning adds value or protection. Next, your attorney will explain how state-specific forms, requirements, and timelines shape your plan, so you understand every step. After preparing your documents, you review and sign them following Utah’s legal requirements for witnesses and notarization. Periodic reviews keep your estate plan current with changing family circumstances, assets, or legal developments. Working with a local attorney like Stevens & Gailey, PLLC ensures your solutions fit Utah’s landscape, from Ogden’s court requirements to statewide estate law changes.

Understanding Estate Planning Instruments & Their Benefits

Several types of legal instruments can form a comprehensive estate plan. Each serves a distinct purpose, and your plan can be as simple as a Last Will and Testament or more complex to address your unique needs and concerns.

When you work with an estate planning attorney in Ogden, you gain guidance on which instruments fit Utah’s current requirements. For example, the state recognizes revocable living trusts and irrevocable trusts, which let you control how you pass on real estate, business interests, or financial assets. An estate planning attorney will help you assess whether a pour-over will or testamentary trust best fits your situation, and will clarify the impact of Utah’s Uniform Probate Code on your decisions. Our team also shows you why updating your estate planning documents as your assets or personal life evolves is crucial for lasting protection.

These legal instruments include:

- Wills: A will is a legal document detailing how your properties and assets will be distributed upon death. You can also name guardians for minor children so your family is cared for according to your wishes.

- Trusts: Trusts allow you to manage your estate during your lifetime and after your death. With a trust, you specify how and when your assets are distributed, providing greater flexibility than a will and possible tax benefits.

- Powers of Attorney: This legal instrument appoints someone to make financial or healthcare decisions on your behalf if you become unable to do so. It lets a trusted individual protect your interests during difficult times.

- Healthcare Directives: Also known as living wills, healthcare directives record your preferences for medical treatment if you become incapacitated. They help your family and healthcare providers understand your wishes, reducing distress and confusion.

By integrating these instruments into your estate plan, you ensure your intentions are honored and your loved ones are protected. Selecting the right combination of tools requires insight into your individual situation. At Stevens & Gailey, PLLC, our attorneys bring clarity to the estate planning process, guiding you in choosing instruments that align with your goals for maximum protection and peace of mind.

Driven by integrity, compassion, & commitment Why Choose Stevens & Gailey, PLLC?

-

Trusted AdvisorsWhether facing complex legal challenges or high-value disputes, you need a firm you can trust. With extensive experience and a reputation for excellence, we are here to guide you through every step with confidence and expertise.

-

Unwavering CommitmentYour success is our priority. Our dedicated team works tirelessly to deliver the best possible outcomes, offering personalized attention and a strategic approach that’s always focused on your needs.

-

Tailored StrategiesHandling complex, high-stakes cases requires a deep understanding of financial intricacies. We specialize in managing high-net-worth cases, crafting personalized legal strategies designed to protect your assets and interests.

-

Bilingual Legal ExpertiseWe’re proud to offer legal services in both English and Spanish. Our bilingual team ensures that language is never a barrier to receiving top-tier legal representation, providing clear communication for all our clients.

How Utah Law Affects Your Estate Plan

Utah’s laws influence your estate plan in several ways. The state maintains its own version of the Uniform Probate Code, which affects how wills are reviewed and how assets pass through probate. Many assets may transfer directly to beneficiaries through joint tenancy or pay-on-death designations, while others may need to go through probate in Weber County District Court if the estate exceeds certain thresholds.

State law also sets specific standards for documents like powers of attorney and advanced healthcare directives. Your estate planning attorney in Ogden will explain differences between Utah and other states, such as rules for small estates or instances where personal property can avoid probate entirely. By keeping up to date with local and state laws, Stevens & Gailey, PLLC helps you keep your plan legally sound and tax efficient for Utah’s communities. Knowing how these details affect your estate gives you clarity about your wishes being honored and your loved ones protected.

What Assets Can Be in Your Estate Plan?

Estates can include many types of assets, each with specific considerations for estate planning and probate.

Certain assets may have unique rules under Utah law. For example, real estate in Ogden or American Fork may trigger transfers, taxes, or approvals in probate court. Retirement accounts and business interests often require tailored planning to ensure a smooth transition, and local business assets may follow different succession rules. Our estate planning attorneys account for these factors so your plan fits your property type and respects local regulations.

Common asset types include:

- Real estate: Your primary residence, vacation homes, rental properties, and land.

- Personal property: Vehicles, boats, jewelry, furniture, art collections, antiques, and other valuables.

- Financial accounts: Checking and savings, certificates of deposit, and money market accounts.

- Investments: Stocks, bonds, mutual funds, retirement accounts, and brokerage accounts.

- Business interests: Ownership in a sole proprietorship, shares in a corporation, partnership interests, or LLC membership.

- Life insurance policies: Policies with a cash value and term life policies.

- Intellectual property: Patents, trademarks, and copyrights.

- Digital assets: Cryptocurrency, online accounts, and digital media.

Each asset may require specific documentation and handling to make sure its distribution aligns with your intentions.

How Much Does Estate Planning Cost in Ogden?

One of the most common questions people ask is what it will cost to put an estate plan in place in Ogden. The answer depends on your situation, the range of documents you need, and the complexity of your goals. Simple estate plans that cover a will and power of attorney often cost less than comprehensive packages that include multiple trusts, healthcare directives, or advanced tax planning strategies.

At Stevens & Gailey, PLLC, we make estate planning accessible. We are forthright about our fee structure and offer payment options tailored to your needs. Pricing reflects the time involved, local legal standards, and the value of professional support to ensure your documents work in Utah’s legal system. For many clients, planning ahead helps avoid costly disputes or court intervention later. If you have questions about pricing or payment plans, contact our office to discuss your needs and receive a clear explanation of what to expect.

Timeline & Steps for Completing Your Estate Plan

Completing an estate plan requires several steps, and the timeline varies based on your needs and engagement with your attorney. In Ogden, the first step is an initial meeting to review your property and discuss priorities. Next, your estate planning lawyer drafts recommended documents, such as wills, trusts, and healthcare directives—tailoring each to your personal and family situation.

After preparing drafts, you receive an opportunity to review and ask questions before signing. In Utah, certain documents—like some trusts or powers of attorney—may require extra signatures or notarization based on state law. The process generally takes a few weeks to complete, although more complex matters or significant asset portfolios may need more time. You have control at every step, with clear communication and timely updates so you always know where your plan stands.